Picture those days when you’ve been feeling tired all day, and by night, you find yourself with a fever. You hurry to the closest pharmacy, but your HMO won’t cover it because the pharmacy isn’t in their network. Or maybe, you find an unusual bump under your skin, but your HMO won’t cover the cost of the necessary MRI screenings.

Wouldn’t it be comforting to have a solution that offers the flexibility and coverage you need in these situations? This is where a Health Savings Account (HSA) comes in.

What is an HSA?

So, what exactly is an HSA? An HSA is your personal cash stash designed for you to save and spend on your health and wellness needs. This special type of savings account allows you to set aside money to pay for qualified health and wellness expenses while earning 7% interest. With your HSA, staying healthy will no longer put a dent in your wallet.

How does the HSA work?

Let’s say you have a doctor’s appointment that costs ₦10,000. Or, you’ve decided to join the fitness family and invest in a gym subscription or perhaps add new skincare products to your routine. Your HSA is designed to cover these costs and more as long as they fall under the health and wellness niche.

The best part? The funds you save grow at a 7% interest rate, making these wellness costs much more affordable. This leads us to an essential question: What exactly does an HSA cover?

What does an HSA cover?

An HSA covers a broad range of health and wellness costs, acting as a safety net for both routine and unexpected medical needs:

– Regular visits to your doctor and prescription drugs for ongoing health care

– Surgical procedures for more serious health issues

– Health aids such as crutches, wheelchairs, and home blood pressure monitors

– Dental and vision expenses like exams, glasses, and contact lenses

– Nursing home services and chronic health management

– Therapy sessions for your peace of mind

– Gym subscriptions for your fitness goals

– Health-boosting products for your overall well-being

– Sanitary products like tampons and pads

– Fertility and maternity services, including in vitro fertilization, breast pumps, and milk storage bags

Your HSA allows you to prioritize all aspects of your health, from prevention to emergency treatments. It’s like having a shopping voucher, where you can pick and choose from a wide array of services and products, all geared towards your health and wellness.

Why do I need an HSA?

We get it, you’re still not convinced. So, what if we told you that with your HSA, you:

1. Save and earn

With your HSA, you’re not just saving money, you’re investing in your health.

It’s a special kind of account where you can set aside money for your wellness needs. And just like a regular bank account, anyone can put money into it, contributing to their health. Plus, these savings grow by 7% over time. So, it’s like having a health-focused bank account that grows with time and centres your well-being.

2. Spend with ease

Gone are the days when you had to stress about affording check-ups or medication.

With your HSA, you set aside funds regularly, creating a reserve that can be used to cover a variety of medical expenses, from routine check-ups to essential medication. It’s accessible right in our Health and Wellness Hub. Think of it as your dedicated health trust fund, ready to use whenever you need it.

3. Cash in on exclusive discounts

Who doesn’t love a good discount?

With your HSA, you have exclusive access to discounted health and wellness services. Whether you’re looking to join a gym, need a new pair of glasses, or want to start therapy, your HSA’s got you covered with tailored discounts that cater to your needs.

It’s more than just another savings account. It’s a comprehensive health and wellness solution, designed with your needs in mind. It’s about giving you the freedom to prioritize your health without worrying about the cost. It’s about providing a safety net that grows with you, so you can focus on living a healthy, fulfilling life.

What’s the difference between HSA and HMO?

Unlike your regular health insurance, which requires you to use specific healthcare providers, HSAs give you the freedom to choose where and how you want to spend your health funds. Here’s a breakdown of how the HSA compares to traditional HMO plans:

1. Your HSA saves and earns interest

With your HSA, your money works for you. As you save for future health and wellness needs, your money earns a 7% interest. In contrast, traditional HMO plans offer no interest or savings options.

2. Your HSA gives you the freedom to spend on any health and wellness service or product

Enjoy the freedom to spend on a variety of health and wellness expenses with ease using your HSA. We are talking about doctor visits, prescription meds, surgical procedures, and even wellness activities like gym subscriptions or therapy sessions. It’s a flexible solution that caters to both routine and unexpected medical needs, from buying glasses and contact lenses to managing chronic health conditions.

Traditional HMO plans, on the other hand, often restrict care options, impose lower spending limits, and create barriers to accessing specialized treatment.

3. With your HSA, you get exclusive access to discounts

Your HSA gives you exclusive access to discounts on health and wellness services and products, like gym memberships, therapy sessions, and wellness products. These discounts come from our partners who are just as committed to your health. Traditional HMO plans may not offer these types of discounts.

4. Funds in your HSA do not expire

Your HSA funds never expire. They roll over year after year, which means you always have a reserve for healthcare needs. Traditional HMO plans, however, typically have an expiration date.

5. You can fund your HSA anywhere, anytime

You can add money to your account whenever you need to. This makes it easy to handle any health costs that come up. Plus, other people can also put money into your HSA. But with regular HMO plans, you don’t get to choose how often you pay. They also don’t give you as many choices for your health care.

You’re starting to like the sound of being in charge of your own health, right? Here’s what you need to do to get your HSA as soon as possible.

How to get started with your HSA

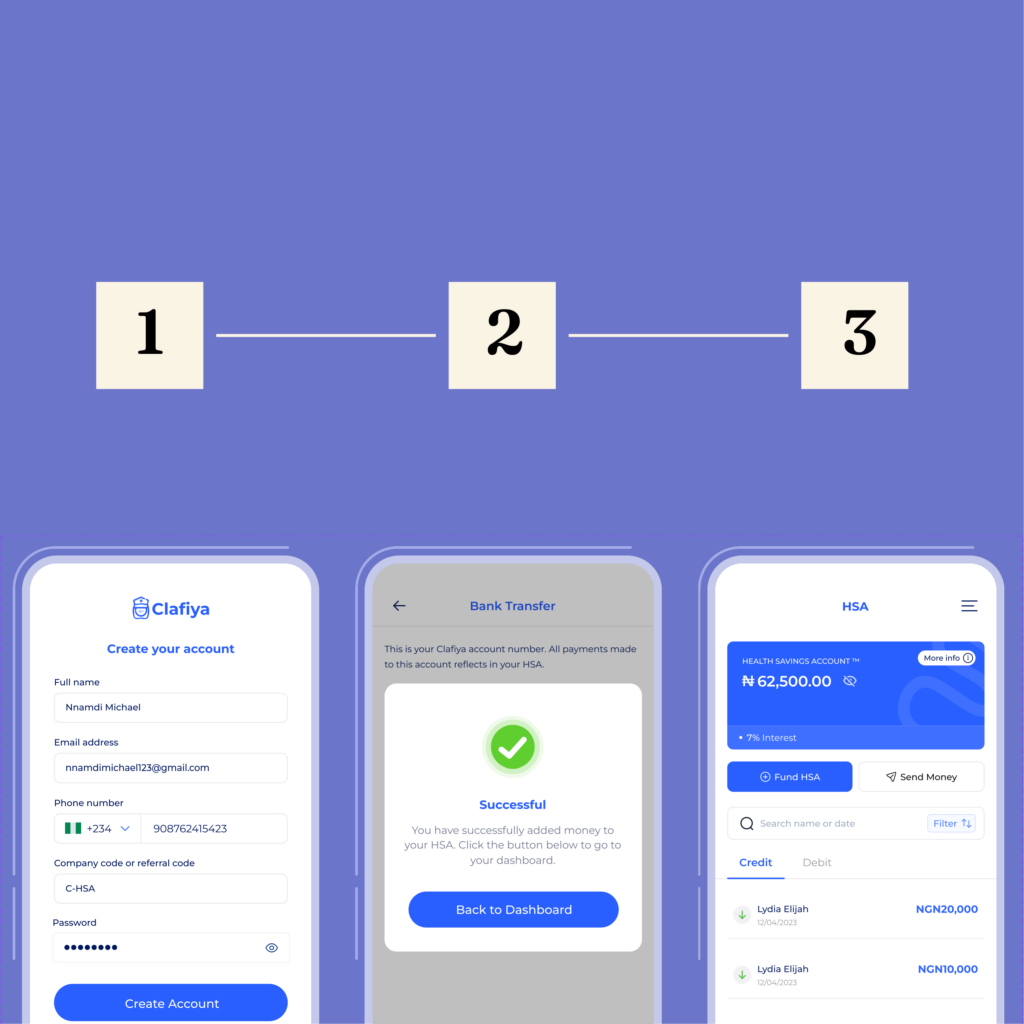

You’re just three easy steps away from owning an HSA:

1. Open an account

First, sign up at clafiya.com. Your account has an activated HSA, so you won’t have to jump through extra hoops. Don’t worry, we’ve got you.

2. Fund your HSA

Next, add some money to your HSA. This is your health fund; you want to make sure it’s ready to cover any health and wellness needs that come your way.

3. Save, spend and watch your money work for you

Your HSA isn’t just a piggy bank; it’s an investment in your health. The funds you save earn an impressive 7% interest, even as you use them for everyday health and wellness costs.

Whether it’s a doctor’s visit, prescription drugs, or even a gym subscription, your HSA is there to cater to it all.

You know how we say in Nigeria, “Scratch my back, I scratch your back?” An HSA is like that. You put money in it, and it not only helps you pay for your health and wellness needs and growing your money by 7% interest. It’s a win-win deal.

Why not start today?

Sign up now to enjoy worry-free healthcare with a growing health fund.