When it comes to staying healthy in Nigeria, many of us are familiar with Health Maintenance Organizations (HMOs). They promise access to healthcare at an affordable price, and for a lot of people, that feels like peace of mind. But if you’ve used an HMO in Nigeria or know someone who has, you might have noticed that it doesn’t always meet all your needs.

From unexpected out-of-pocket expenses to limited hospital networks and exclusions for pre-existing conditions, HMOs often fall short in providing the complete care you need. These gaps can leave you feeling frustrated and financially strained, especially when you’re faced with emergencies or ongoing health challenges.

In this article, we’ll explore why HMOs in Nigeria are helpful but not enough for the full scope of healthcare you may need. I’ll also share an alternative: the Health Savings Account (HSA), which can be a game-changer for managing your health expenses.

Why are HMOs in Nigeria not enough?

HMOs serve as a great starting point, but they come with some major gaps that you can’t ignore. If you use an HMO in Nigeria, you can relate to two or more of these:

1. HMOs in Nigeria have limited coverage

HMOs in Nigeria often come with strict limits on what they cover. Many plans only cater to basic outpatient consultations, simple lab tests, or generic drugs. If you need specialized care, advanced tests, or surgery, you’re either going to pay out of pocket or find yourself stuck.

2. HMOs in Nigeria have network restrictions

HMOs usually have a network of hospitals and clinics you must use. This sounds great until you realize the closest hospital in their network is far from you or doesn’t have the resources to treat you properly. If you want to use a hospital outside the network, you’ll have to cover the cost yourself.

3. HMOs in Nigeria have hidden costs

It’s easy to assume that once you pay your HMO premium, you’re good to go. But many people discover hidden costs along the way—things like additional lab fees, consultations not covered under your plan, or medications that aren’t on the approved list. These surprise expenses can add up fast.

4. HMOs in Nigeria have exclusions for pre-existing conditions

Many HMOs in Nigeria do not cover pre-existing conditions like diabetes, hypertension, or asthma. For individuals living with these conditions, the lack of coverage can be a significant setback, leaving them to bear the full cost of managing chronic health issues. This limitation makes HMOs less reliable for those who need continuous care.

5. HMOs in Nigeria have limited emergency care options

Emergencies don’t wait, but your HMO plan might. Some HMOs in Nigeria have restrictions on emergency care or require pre-authorization before treatment can begin. In critical moments, delays like this can make all the difference, leaving you to fend for yourself financially and medically.

Now, let’s tell you what’s better—The Health Savings Account (HSA)

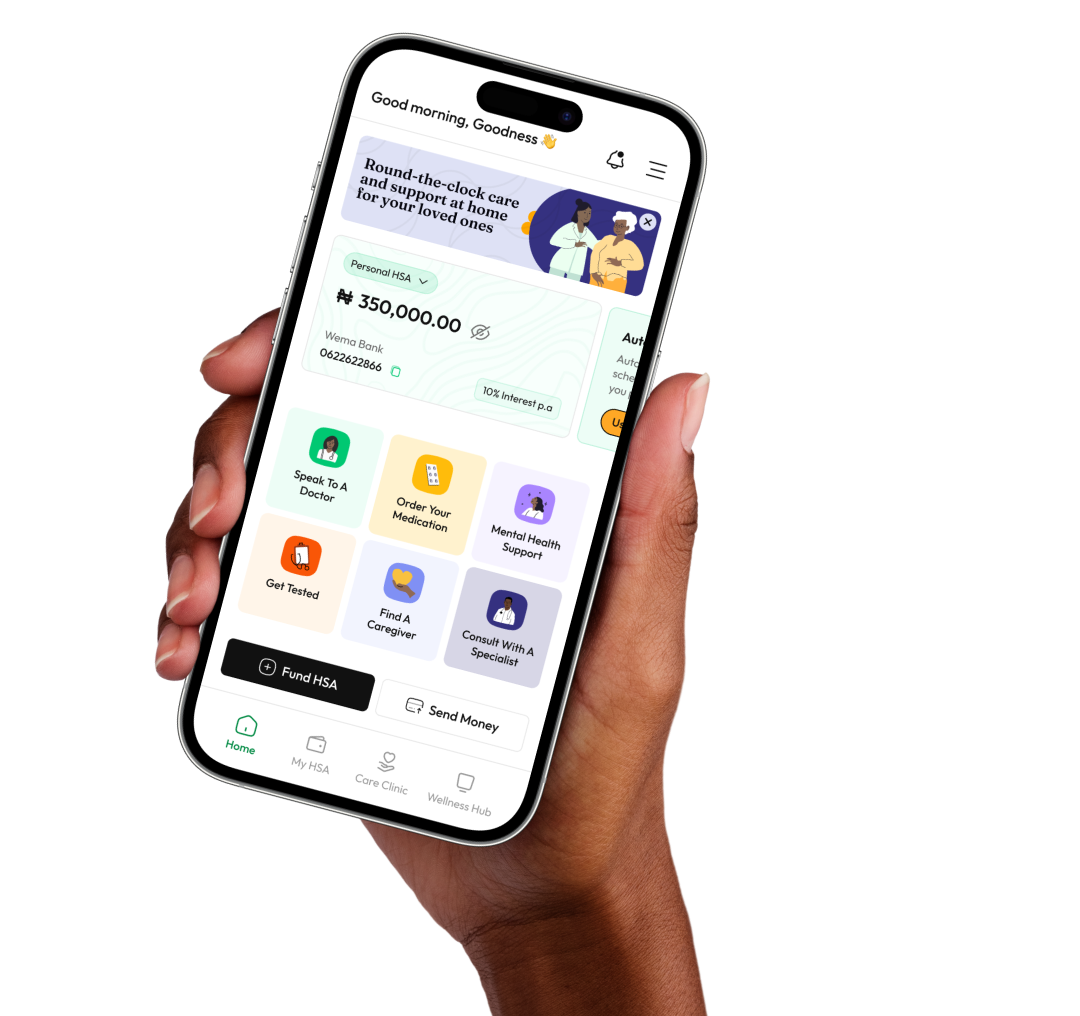

If HMOs in Nigeria leave you feeling frustrated, there’s a better way to manage your health expenses—the Health Savings Account (HSA). An HSA is a personal savings account designed to help you save and pay for health-related costs while you earn 7-10% interest. Unlike an HMO, an HSA gives you more control, flexibility, and coverage for your healthcare needs.

Here are five reasons why you need an HSA:

1. Your HSA covers everything HMOs don’t

HSAs can be used to cover health and wellness expenses that HMOs often exclude, like specialized tests, alternative treatments, spas, gyms and even pre-existing conditions. This means you can take charge of your health without limitations.

2. Your HSA earns interest over time

Many HSAs in Nigeria come with the added benefit of earning interest. This means your savings grow over time, helping you build a stronger financial foundation for future healthcare needs.

3. There are no restrictions on providers while using your HSA

With an HSA, you’re not limited to a specific hospital or clinic network. You can choose any healthcare provider that suits your needs, ensuring you get quality care without worrying about “approved networks.”

4. Your HSA builds you a safety net

Life is unpredictable, and medical emergencies can happen at any time. An HSA helps you prepare by allowing you to save consistently. Instead of scrambling for funds during a crisis, you’ll have a cushion to fall back on.

5. Your HSA gives you full control of your money

Unlike HMOs, where you’re locked into a plan, an HSA gives you complete control over your contributions and how you use the funds. There’s no waiting for approvals or pre-authorizations—you decide when and where to spend your money.

5 things you’ll get with an HSA

1. Flexibility: You get to use your HSA funds for any health-related expense, from consultations and medications to skincare products and gym subscriptions.

2. Control: You get to decide how much to save and when to use your funds. The best part you get interest and access to exclusive discounts of up to 30% off.

3. Peace of mind: With your HSA, you always have a financial backup for emergencies.

4. No expiry: Your HSA contributions don’t “expire” like unused HMO benefits.

5. Transparency: There are no hidden charges or unexpected fees when you use your HSA.

Now, how do you create an HSA?

1. Open an account

First, sign up at clafiya.com. Your account has an activated HSA, so you won’t have to jump through extra hoops. Don’t worry, we’ve got you.

2. Fund your HSA

Next, add some money to your HSA. This is your health and wellness fund; you want to make sure it’s ready to cover any health and wellness needs that come your way.

3. Save, spend and watch your money work for you

Your HSA isn’t just a piggy bank; it’s an investment in your health. The funds you save earn an impressive 7-10% interest, even as you use them for everyday health and wellness costs.

Whether it’s a doctor’s visit, prescription drugs, or even a gym subscription, your HSA is there to cater to it all.

While HMOs in Nigeria offer some level of healthcare support, they’re simply not enough to cover all your needs. The limitations—hidden costs, restricted networks, and lack of comprehensive coverage—can leave you feeling unprepared for life’s medical challenges.

A Health Savings Account, on the other hand, puts you in control of your health and your finances. With flexibility, full coverage for your unique needs, and the ability to grow your savings on a juicy 7 -10% interest rate, it’s a solution built for real-life situations.

We can help you take the first step today. Text us on WhatsApp at 09134275854, and we’ll guide you through the process.

Take your health into your own hands—you deserve it.