If you live in Nigeria right now, you know how tough the economy has been in 2024. This has made managing money a priority for all of us. With the rising costs of living, coupled with unexpected healthcare expenses, it is never been more important to think of smarter ways to handle our finances. Whether you’re a young professional, a business owner, or raising a family, having access to affordable healthcare can ease a lot of the stress.

This is where options like Health Savings Accounts (HSAs) and Health Maintenance Organizations (HMOs) come in. But you might be wondering, what’s the difference between a Health Savings Account (HSA) and an HMO, and which one is better for you? Let’s get into the reasons, so you can make the best decision for your health and your wallet.

What’s the difference between a Health Savings Account (HSA) and HMO?

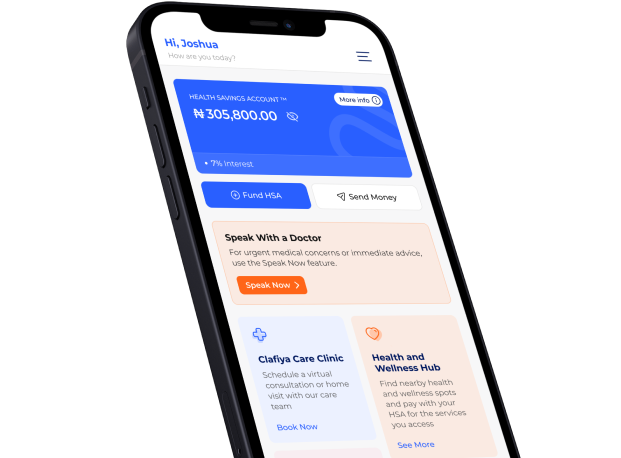

First, we define them. What is a Health Savings Account (HSA) and what is an HMO? A Health Savings Account (HSA) is a personal savings account where you set aside money specifically for your health and wellness expenses. It’s like having a special piggy bank for your health. The best part is that the money you save grows over time, meaning the more you contribute, the more you have to spend when those unexpected medical costs pop up. With Clafiya’s HSA, you get 7% interest on your every penny. And yes, you have full control over it.

An HMO (Health Maintenance Organization), on the other hand, is a type of health insurance plan. With an HMO, you pay a fixed monthly or annual fee to a health insurance company in Nigeria, and in return, you get access to a range of medical services. However, HMOs usually have specific doctors or hospitals you must use, and there can be limitations on the type of care you receive depending on your plan.

The main difference is control. With an HSA, you are the boss of your savings and health expenses, while an HMO limits your choices based on the plan you’re on.

Now, let’s get into the details and compare these two options side by side.

10 key differences between a Health Savings Account (HSA) and HMO

These are the major differences between the Health Savings Account (HSA) and HMO

1. It’s free to open a Health Savings Account (HSA)

One of the best things about an HSA is that it’s completely free to open. There are no setup fees or hidden costs, making it a cost-effective option for anyone looking to manage their healthcare expenses. In contrast, an HMO requires regular payments, which can add up even if you don’t need to use the service frequently.

2. The money in your Health Savings Account (HSA) grows

Another exciting thing about having a Health Savings Account (HSA) is that your money grows. With Clafiya’s HSA, your balance earns an interest rate of 7%. This means your savings don’t just sit there – they grow over time, helping you prepare for future health expenses. With an HMO, you pay your premiums every month, but you don’t see that money growing or coming back to you, especially if you don’t go to the hospital often.

3. The money in your Health Savings Account (HSA) never expires

Unlike HMOs where your plan may expire after a year and unused services are lost, your HSA savings roll over from year to year. This means that the money you save today in 2024 can still be used in the future – 2030, even decades down the line. You can accumulate a significant health fund without worrying about losing it.

4. You can fund your Health Savings Account (HSA) anytime, anywhere

Life can be unpredictable, and your health savings should adjust to your needs. With an HSA, you can add funds whenever and wherever you want. There are no strict deadlines or pressure to top it up monthly. You have full control over how much you save and spend on your healthcare.

5. With your Health Savings Account (HSA), you control what you want to spend your money on

With an HSA, there’s no limit on what you can spend as long as it’s for health and wellness. Whether it’s for a doctor’s visit, medications, spa, gym, prescribed glasses or even wellness products, you have the freedom to spend as needed. With an HMO, you’re restricted by the plan’s limits and tiers – certain treatments or services may not be covered unless you upgrade your plan.

6. Your Health Savings Account (HSA) gives you specialised healthcare coverage

Your Health Savings Account (HSA) gives you access to pay for a wide range of specialised healthcare, including dental care, eye care, surgeries, and even mental health care. This is a big advantage over HMOs, which may only cover basic services, with extras requiring a more expensive plan.

7. Your Health Savings Account (HSA) covers alternative health and wellness treatments

With an HSA, you’re not just limited to mainstream healthcare. You can use your savings to pay for alternative treatments like acupuncture, herbal medicine, and chiropractic care. HMOs typically don’t cover these types of treatments, keeping you confined to conventional medical care.

8. Your Health Savings Account (HSA) doesn’t have monthly or annual premiums

With an HMO, you’re required to pay a monthly or annual premium regardless of whether you use the services. With an HSA, there are no recurring payments. You fund your account whenever and however you want. You only deposit what you can afford, giving you full control over your healthcare savings.

9. Your Health Savings Account (HSA) gives you access to exclusive discounts of up to 30%

Clafiya’s HSA comes with the added bonus of exclusive discounts. When you have an HSA, you get up to 30% off at partner brands in the Health and Wellness Hub, such as Medplus for medications, I-Fitness for gym subscriptions, and BeautyHut for skincare amongst others. These are benefits you don’t usually get with an HMO.

10. With your Health Savings Account (HSA), you have flexibility of choice with healthcare providers

With an HMO, you are often required to stick to a network of doctors and hospitals. If you want to see a specialist outside this network, you may have to pay out of pocket. With an HSA, there’s no such restriction. You can choose any healthcare provider, and as long as you have funds in your account, you’re covered.

Read: 10 Things You Can Do With Your Health Savings Account (HSA)

Both Health Savings Accounts (HSAs) and HMOs have their benefits, but the key is to know what works best for your lifestyle. If you want more control over your healthcare spending, flexibility in your healthcare choices, and the opportunity to grow your savings, an HSA is your best bet. On the other hand, if you prefer a fixed, predictable plan with set limits and coverage, an HMO might be more suitable.

Take control of your health and wellness today by opening a Health Savings Account (HSA) with Clafiya. With a Clafiya Health Savings Account (HSA), you can start saving for your health today, earn 7% interest on your balance, and enjoy exclusive discounts with partner brands of up to 30%. And the best part? It’s completely free to open your account.

You deserve a healthier, stress-free life.