With the rising cost of living, many people find it harder to pay for healthcare needs out of their own pockets. This is where health insurance and Health Maintenance Organizations (HMOs) come in. Choosing the best HMO in Nigeria can help you manage your finances while providing the comfort of knowing you can access the care you need without the stress of high upfront costs. In a country where the best health insurance options can make a significant difference, finding the best HMO for you and your family is important.

What exactly is health insurance/health maintenance organisations (HMO)?

Health insurance is a type of coverage that helps pay for your medical expenses. It functions as a safety net, ready to catch you financially if you fall ill and need medical care. You pay a small amount at chosen intervals, and the insurance company pools these funds. If you or anyone in the pool needs medical care, the insurance company uses this pool of funds to help cover the costs. This way, you can focus on getting better without the added stress of high costs.

Why choosing the best HMO in Nigeria matters

Picking the right HMO is important for keeping your family’s health and finances in check. With many options out there, your choice can really affect your healthcare experience. Here’s why choosing the best HMO in Nigeria is so important:

- Good coverage: The best HMOs cover a wide range of medical services, like hospital visits, check-ups, and preventive care. This means you won’t have to worry about paying a lot of money when you or your family need medical help.

- Quality care: Top HMOs work with good hospitals and doctors, so you can trust that you’ll get quality care when you need it. A good HMO will make sure you and your family are in safe hands.

- Affordable plans: Health insurance can be expensive, but the best HMO for families in Nigeria provides budget-friendly plans with great benefits. By comparing different HMOs, you can find a plan that fits your budget while covering important health needs.

- Helpful customer service: The top HMOs in Nigeria prioritize their customers and provide support when needed. Whether you have questions about your coverage or need assistance with claims, good customer service can make your life easier.

- Peace of mind: Knowing you’ve chosen a reliable HMO allows you to focus on what really matters—your health and your family’s well-being. With the right HMO, you can feel secure knowing that good healthcare is just a phone call away.

By understanding why it’s important to choose the best HMO in Nigeria, you can make smart choices that protect your family’s health and financial future.

How to choose the best HMO plan for you

In Nigeria, various health insurance plans are available to you, catering to different needs and preferences. With the growing number of health insurance companies in Nigeria, it can be challenging to choose a health plan that suits your needs.

Here are a few factors to consider while selecting a suitable healthcare plan:

Coverage: You have to make sure that the plan you choose covers a wide range of medical services, including preventive care, emergency services, and specialized treatments.

Network of health providers: Check if the HMO has a comprehensive network of hospitals, clinics, and specialists that are easily accessible to you.

Cost: Read up on the premiums, co-pays, deductibles, and out-of-pocket maximums to understand the total cost of the plan.

Customer service: Look for HMOs with a reputation for excellent customer service and quick claims processing.

Additional benefits: Consider extra benefits like wellness programs, maternity care, chronic healthcare and dental coverage.

By taking these factors into account, you can confidently choose the best HMO in Nigeria that aligns with your health and financial goals.

Top 10 HMOs in Nigeria

From the most affordable to the most expensive, here are 10 of Nigeria’s top health insurance plans, with their unique offerings and prices.

1. AXA Mansard HMO

AXA Mansard HMO, a part of the global AXA Group, offers a range of flexible health insurance plans that provide comprehensive coverage for your health needs. With their plans, you can access over 1,000 healthcare centres across Nigeria for doctor consultations, laboratory tests, medication, vaccinations, and even emergency care. The stand-out feature for Axa Mansard HMO is that they also offer international plans that allow you access healthcare anywhere in the world.

Cost: They have a subsided plan starting at ₦12,000 for 6 months but more comprehensive plans for individuals start at ₦58,446. For a quote for your company, visit their website.

2. Well Health Network Limited

Well Health Network Limited is a health insurance provider in Nigeria that stands out for its affordability. They are known for their low-cost plans and partnerships with well-known hospitals and healthcare providers. They offer a wide range of services, including inpatient and outpatient services, emergency care, and specialized treatments. This ensures that enrollees can access the care they need without financial worry.

Cost: Annual plans for individuals start from ₦18,500, and from ₦35,500 for couples. For a detailed insight into their corporate plans, please visit to their website.

3. Anchor HMO

Anchor HMO offers a range of products and services designed to give access to quality healthcare services. Their affordable plans and partnerships with reputable hospitals and healthcare providers make them a popular choice for many. They offer coverage for inpatient and outpatient services, emergency care, and specialized treatments, ensuring peace of mind for their enrollees.

Cost: Their basic individual plan starts from ₦24,000 per annum. Visit their website for more information on their plans for business entities.

4. Avon HMO

Avon HMO is a fast-growing health insurance company in Nigeria, known for their patient-centric plans. They offer a variety of health plans for individuals, families, and businesses, but are particularly distinguished by couple plans, which consider many people who are married without kids. Their network includes a wide range of healthcare providers, that promise comprehensive coverage, including maternity care, chronic disease management, and preventive services.

Cost: Their plans start at ₦27,500 for individuals while their couple plans go for ₦80,696 per year and family plans for ₦222,750. Fill out this form for a quote for your business.

5. Novo Health Africa HMO

Novo Health Africa HMO is a distinguished health insurance provider in Nigeria, known for its commitment to delivering quality and affordable healthcare services. They offer a wide range of health plans that cater to individuals, families, and businesses and even offer plans for Nigerians in the diaspora looking to cover their loved one’s healthcare needs. Their offerings are comprehensive, providing inpatient and outpatient services, emergency care, and specialized treatments.

Cost: Their plans start from ₦31,500.00 per annum. Visit their website for more information on their plans for business entities.

A pocket-friendly, flexible alternatives to HMOs: Health Savings Accounts

While HMOs offer structured health insurance plans, an alternative worth considering is a Health Savings Account (HSA), especially if you live in Nigeria.

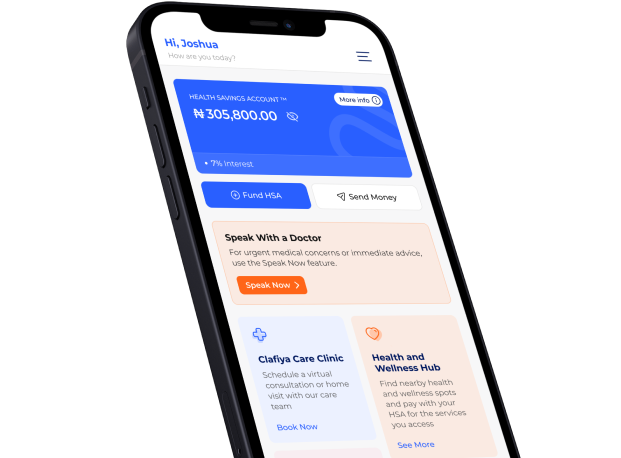

An HSA is a special savings account designed to save and spend on your health and wellness needs. With your HSA, you can set money aside regularly to pay for all your health and wellness expenses while earning 7% interest. HSAs offer a more comprehensive and flexible approach to health and wellness spending compared to traditional HMOs. Here’s how:

1. Flexibility in spending: With your HSA, you’re not limited to a specific network of healthcare providers. You can use your funds for all your health and wellness needs, including doctor’s visits, surgeries, gym subscriptions, fitness accessories, eye or dental care and even skincare products. This freedom makes it easier to tailor your healthcare spending to your specific needs and preferences.

2. Control over your money: Your HSA funds never expire; they’re yours to keep, rolling over year after year. The best part is you earn interest so your money grows as you grow. This means you will always have money to sort out future health bills. On the other hand, unused funds in an HMO plan often expire, which is a major drawback if you’re looking for a way to save for long-term health and wellness goals, such as elective surgeries or fertility treatments.

3. Exclusive discounts: With your HSA, you enjoy exclusive discounts on health and wellness services and products from partners in our Health and Wellness Hub. With these discounts, you can save up to 30% on everything from gym memberships to mental health care, which are usually not available with a regular HMO plan.

Bonus: You also have access to our 24/7 Care Clinic where you can speak to a Doctor whenever and wherever you want in Nigeria, as well as get drugs and diagnostics services done.

6. Clearline HMO

Clearline HMO provides affordable health insurance plans with extensive coverage of over 1800 partner hospitals. Companies like AirPeace and Vitafoam trust them to deliver healthcare services that are accessible and affordable, catering to the needs of individuals, families, and corporate clients.

Cost: Their personal care plans start from ₦50,000. For a quote for your business, visit their website.

7. Hygeia HMO

Hygeia HMO offers a wide range of health plans for individuals, families, and businesses, including specialized care for senior citizens and maternity needs. They are distinguished by their extensive network of over 1,800 partner hospitals and clinics, ensuring wide-ranging coverage from healthcare.

Cost: Their individual plans start at ₦55,590 per year, family plans start from ₦230,112 and senior citizen plans from ₦203,796. For a quote for your business, visit their site here.

8. Leadway HMO

Leadway HMO, a subsidiary of Leadway Assurance Company, is known for its strong capital base, high service standards, and prompt claims settlement. They offer packages that cater to different healthcare needs, including inpatient and outpatient services, emergency care, and specialist consultations.

Cost: Their plans start at ₦69,998.50 per year. They also offer packages for large companies and small and medium-sized businesses. Visit their website for more information.

9. MetroHealth HMO

MetroHealth HMO is another health maintenance organization in Nigeria, dedicated to providing quality healthcare services through its health insurance plans. They offer a wide range of medical services, including preventive care, diagnostic tests, and specialist consultations.

Their plans start from ₦ 130,000 per annum for individuals. For more information on how their business plans work, visit their website.

10. Reliance HMO

Reliance HMO is a standout health insurance company in Nigeria for its comprehensive employee health services. What particularly sets them apart from the other HMOs is their holistic approach, providing mental health support, preventive care, and even perks like gym and spa access for overall well-being.

Cost: You can get a quote for your company by emailing: hellonigeria@getreliancehealth.com.

Nigerian HMO comparison chart: Top health insurance options in Nigeria

| HMO name | Coverage type | Monthly premium (NGN) | Network size | Family plans available |

|---|---|---|---|---|

| NIMR HMO | Comprehensive | 10,000 | Large | Yes |

| AXA Mansard Health | Flexible | 12,000 | Very Large | Yes |

| HealthPlus HMO | Extensive | 9,000 | Large | Yes |

| Med-Plus HMO | Affordable | 8,500 | Medium | Yes |

| Reliance HMO | Personalized | 11,000 | Medium | Yes |

| Universal Insurance HMO | Competitive | 9,500 | Large | Yes |

| Blue Cross HMO | Wide range of services | 10,500 | Large | Yes |

| Mutual Benefits HMO | Accessible | 8,000 | Medium | Yes |

| Total Health HMO | Preventive care focus | 10,000 | Medium | Yes |

| First Health HMO | User-friendly online access | 11,500 | Large | Yes |

Living in Nigeria comes with its daily costs and if you’re looking for a better health and wellness care solution that gives you more control over your funds, an HSA is the perfect fit for you.

The best time to start saving for your health is NOW.