If you’re a Nigerian, living and working in today’s tough economy, you’ve probably felt the weight of rising healthcare costs. Every day, we face uncertainties about medical expenses, and trying to save for both emergencies and our future health feels like an uphill battle. But here’s the thing—there’s a better way to manage your healthcare expenses, and it doesn’t involve overpaying for health insurance or worrying about limits on care. Allow me to introduce you to the Health Savings Account (HSA), which is turning heads for all the right reasons.

Clafiya’s Health Savings Account (HSA) allows you to save for medical expenses while earning 10% interest on your balance. Yes, you read that right. Your money grows while you save. On top of that, you can enjoy discounts of up to 30% on all health and wellness products and services. This includes medications, vitamins, dental care, prescription glasses, and gym memberships. It sounds juicy but with anything new, there are bound to be questions, and trust me, I had plenty of my own when I first heard about HSAs.

In this article, we’ll be answering the top 20 questions Nigerians have about Health Savings Accounts (HSAs) and why they are the smarter choice over HMOs in our current economy.

1. What is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a savings account specifically for your health and wellness expenses. It allows you to save money to cover healthcare costs while earning 10% interest on your balance. Unlike traditional health insurance, your HSA is your own personal fund that grows over time. You can use it for a variety of health and wellness expenses with access to up to 30% discounts, and the best part is, it rolls over year after year—your money never expires.

2. How does a Health Savings Account (HSA) work?

Think of an HSA as your personal piggy bank for healthcare. You deposit money into the account, and when you have health and wellness expenses, you can spend it on those needs. Plus, unlike an HMO, where you’re limited to certain services, you can use your HSA for a wide range of health and wellness needs. As long as your expenses are related to health and wellness, from doctor visits to gym subscriptions, you’re covered.

The money in your HSA grows with 7% interest, which is far better than what many Nigerian savings accounts offer.

3. How can I open a Health Savings Account (HSA)?

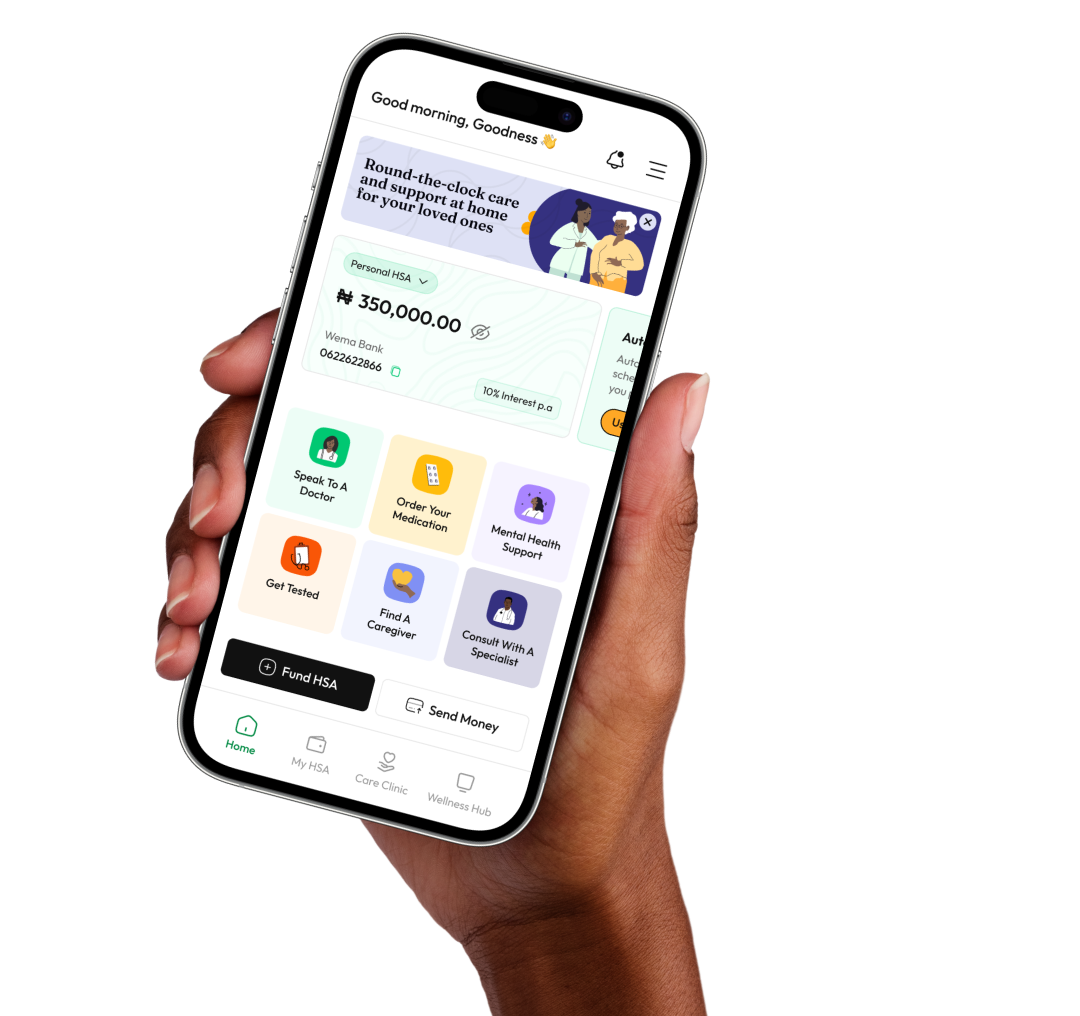

Opening a Health Savings Account (HSA) is straightforward. You can open it for free without any hidden fees. All you need to do is sign up at clafiya.com and you’re automatically assigned your Health Savings Account (HSA) number you can start funding immediately. There are no complicated paperwork or strict eligibility requirements, and you can begin using your HSA immediately for your health and wellness needs.

4. What’s the difference between a Health Savings Account (HSA) and an HMO?

A Health Savings Account (HSA) and a Health Maintenance Organization (HMO) are two different systems for managing healthcare expenses.

Health Savings Account (HSA): It’s a personal savings account where you decide how much to contribute and what medical expenses to spend it on. With Clafiya’s HSA, your money earns 10% interest and doesn’t expire, giving you more flexibility and control over your health care.

HMO: An HMO is a type of health insurance plan that requires you to pay a fixed monthly premium for healthcare coverage, but you may be limited to certain doctors, hospitals, and treatments covered by the insurance company.

In today’s Nigerian economy, an HSA can be a more flexible option since it allows you to save money while giving you access to broader health and wellness options, including discounts on things like gym memberships, mental health care, doctor visits, tests and vitamins. On the other hand, an HMO can be restrictive in terms of coverage and services.

Read more here: What’s The Difference Between A Health Savings Account (HSA) & HMO?

5. What can I use a Health Savings Account (HSA) for?

You can use your HSA for a wide range of health and wellness expenses. Some of the most common uses include:

- Doctor visits

- Prescription medications

- Wellness products like vitamins

- Dental care

- Vision care

- Mental care

- Lab tests

- Gym memberships

The beauty of a Health Savings Account (HSA) is that it gives you the flexibility to spend on things that matter to your health, without the strict limitations of health insurance companies in Nigeria.

Read: 10 Things You Can Do With Your Health Savings Account (HSA)

6. Can I use a Health Savings Account (HSA) for massage?

Yes, you can. One of the great benefits of having a Health Savings Account (HSA) is access to a list of spas in our Health and Wellness Hub. Some of these spas offer up to 30% discounts when you pay with your HSA. Whether you’re getting a massage for relaxation or stress relief, your HSA makes it easier and more affordable to prioritize your well-being.

7. Can I use a Health Savings Account (HSA) for dental care?

Absolutely. Dental care is a crucial part of overall health, and you can use your Health Savings Account (HSA) to cover expenses such as cleanings, fillings, and even more significant procedures like root canals or dental surgery.

8. Can I use my Health Savings Account (HSA) for my spouse?

Yes, your spouse and other loved ones can use your Health Savings Account (HSA) as long as you add them as beneficiaries. You can also set spending limits for them to monitor how much they spend. An HSA isn’t just for the account holder—it’s a flexible tool that can benefit your entire family by covering their health and wellness needs.

9. Can I use a Health Savings Account (HSA) for gym membership?

Yes, another fantastic perk of a Health Savings Account (HSA) is that you can use it to cover fitness-related costs like gym memberships. Staying healthy means more than just doctor visits; it’s about taking care of your body, and your HSA recognises that.

10. Can I buy vitamins with a Health Savings Account (HSA)?

Yes, your Health Savings Account (HSA) can be used to purchase vitamins and other wellness products. This is a big advantage over an HMO, which often restricts what you can spend on.

11. Does a Health Savings Account (HSA) balance rollover?

Yes, your Health Savings Account (HSA) balance rolls over from year to year, so you don’t lose any of the money you’ve saved. Even better, your balance earns a 10% interest, helping your savings grow over time. This is a key difference from most health insurance plans, where benefits expire at the end of the year, leaving you with nothing to carry over.

12. Can I use a Health Savings Account (HSA) for glasses?

Yes, vision care, including prescription glasses, is a valid expense for your Health Savings Account (HSA). This means you can use your HSA to cover regular eye check-ups and eyeglasses. Even better, you can access exclusive discounts from facilities in our Health and Wellness Hub, with up to 30% off on services and products when you use your HSA. It’s a smart way to save while taking care of your eyes.

13. Does the Health Savings Account (HSA) balance expire?

No, your Health Savings Account (HSA) balance doesn’t expire. The money you save stays in your account forever, and it continues to grow with 10% interest.

14. How much should I contribute to a Health Savings Account (HSA)?

How much you contribute to your Health Savings Account (HSA) depends on your healthcare needs and financial goals. Some Nigerians set aside small amounts monthly, while others make larger contributions. It’s important to note that the more you save, the more you benefit from the 10% interest and discounts on health-related services.

15. Who can contribute to a Health Savings Account (HSA)?

Anyone can contribute to your Health Savings Account (HSA), including you, your employer, and even family or friends. It’s a flexible way to grow your healthcare fund.

16. Can I use a Health Savings Account (HSA) for Lasik eye surgery?

Yes, you can use your Health Savings Account (HSA) to cover costs associated with Lasik eye surgery, because it’s considered a necessary medical expense.

17. What happens to a Health Savings Account (HSA) when I die?

If you pass away, your Health Savings Account (HSA) can be transferred to a designated beneficiary, such as a spouse or family member. They can continue to use the funds for health and wellness expenses.

18. Can I use a Health Savings Account (HSA) to pay for health insurance?

Yes, you can use your Health Savings Account (HSA) to pay for health insurance. Plus, when you purchase HMO plans through our Health and Wellness Hub, you can enjoy exclusive discounts of up to 30%, making it even more affordable to manage your health insurance costs.

19. How do I check my Health Savings Account (HSA) balance?

You can easily check your Health Savings Account (HSA) balance through your dashboard when you log in at clafiya.com. Once you’re logged in, you can track your savings and expenses with just a few clicks. Plus, Clafiya sends notifications via text and email after every transaction, so you’re always up-to-date on your account balance.

20. Can I use a Health Savings Account (HSA) along with an HMO plan?

Yes, you can have both a Health Savings Account (HSA) and an HMO. While an HMO provides health insurance coverage, your HSA offers a way to save money specifically for your health and wellness. Having both allows you to benefit from your HMO’s coverage though limited while also using your HSA to cover out-of-pocket costs like daily essential health needs, treatments not covered by your HMO, or even wellness services. Plus, your Clafiya HSA gives you access to exclusive discounts of up to 30% on health and wellness services, making it an even smarter choice.

In this Nigerian economy where every naira counts, a Health Savings Account (HSA) offers a cost-effective way to manage your healthcare costs. From 10% interest growth to discounts of up to 30% on health and wellness products, an HSA gives you more control over your healthcare savings and expenses. It’s completely free to open, and the benefits far outweigh what an HMO can offer.

Open your free HSA today and take control of your healthcare costs while enjoying the benefits that make a real difference in your pocket.